Zoopla for estate agents

Get your listings in front of the highest-intent home movers. Then, add to them with our range of products to attract more vendors and applicants, and build your estate agency brand.

Get your listings in front of the highest-intent home movers. Then, add to them with our range of products to attract more vendors and applicants, and build your estate agency brand.

Reach your development goals faster with a Zoopla membership. List on pages that average 120m views a month – then add to them from a whole ecosystem of marketing tools.

We’re the leaders when it comes to property market research. See our latest House Price Index and Rental Market Reports here on Zoopla Advantage, as well as loads more estate agent and housebuilder insight.

Leanne Helm – Director of Ayr-based Lily Girl Estate Agents – spoke to Zoopla Advantage about how she’s shaking up the local property scene, with a little help from some Zoopla tools.

You’re never far from a great Zoopla agent – and Orkney’s no exception. Managing director and founder of the island group’s leading agency K Allan Properties, Karen Allan, spoke to us about how our tools are supporting her ambitious expansion plans.

See more about improvements to our search results pages, new optimisations for reduced price listings, and how we’re encouraging home buyers back into local markets.

We’ve rounded up some of the latest renter and landlord trends inside and outside of Zoopla – and we sum up what they mean for your branch.

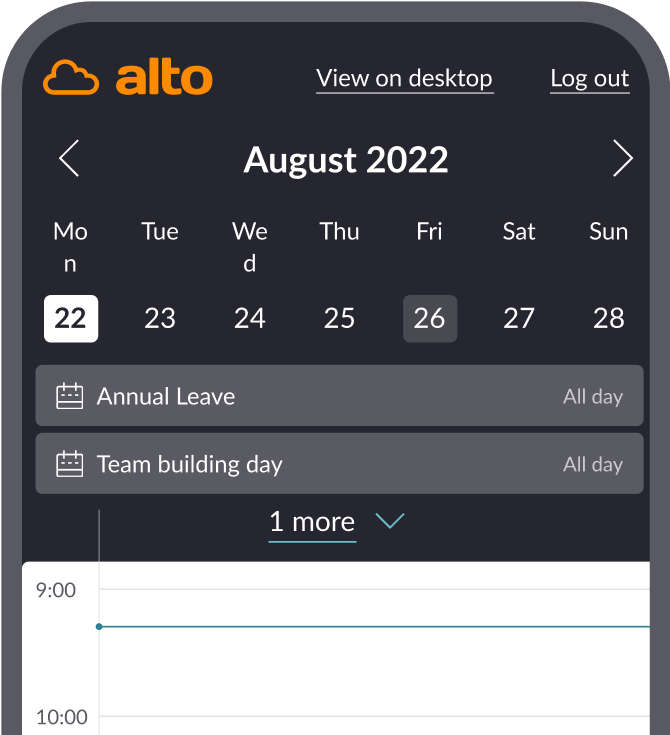

Part of the Zoopla family, Alto’s cloud-based sales and lettings platform is just the start.

With client accounting and property management functionality, and integrations with leading prop-tech providers, it powers your whole business.