Search

close

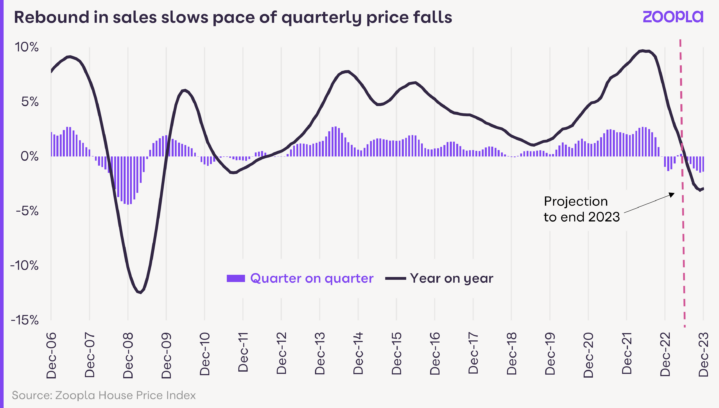

Annual UK house price inflation

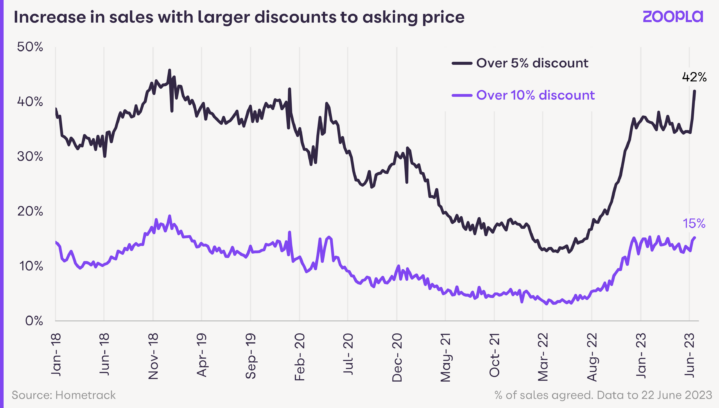

Sellers accepting discounts of more than 5% off the asking price

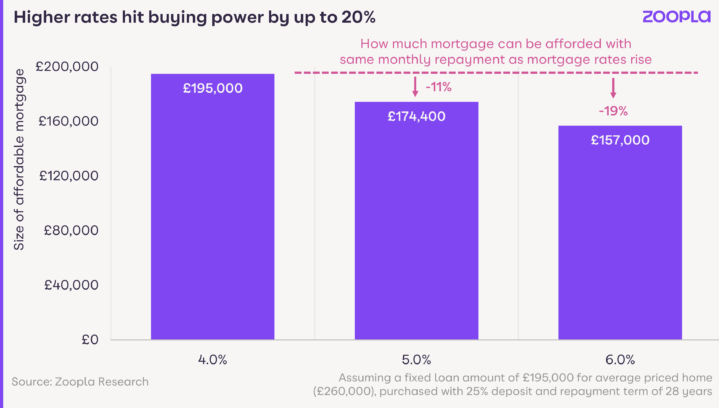

Hit to buying power from mortgage rates rising from 4% to 6%

“Falling mortgage rates over H1 2023 boosted sales and led to firmer prices. This is set to reverse in H2 as higher mortgage rates hit buying power at a time when sellers are having to accept larger discounts to asking prices."

After a better-than-expected start to 2023, the affordability dynamics for new home buyers have deteriorated over recent weeks. Stubbornly high inflation has spooked financial markets with expectations that UK interest rates peak at 6%. Mortgage rates have increased by over 1%, now averaging between 5%-6%, compared to <4.5% this Spring.

Our view remains that 5% mortgage rates represent a tipping point, beyond which house prices will post annual price falls with below average sales volumes. This report explores the very latest trends and concludes that we are still on track for price falls of up to 5% in 2023.

Mortgage rates falling towards 4% over the early months of 2023 supported a recovery in demand and sales. UK consumer confidence has also rebounded over the last 5 months as the labour market remains strong, earnings rise and energy prices started to fall.

Total new sales agreed in the first 5 months of the year recovered to within 2% of the 5-year average. This improvement in sales volumes has led to a small increase in the 3-month rate of house price growth, reversing the quarterly price falls recorded over Q4 2022 and Q1 2023.

Other indices have shown a similar pattern recently indicating that sub 5% mortgages are consistent with +/-2% house price inflation. Sales agreed over the last 4 weeks are 8% above the average for the last 5 years as households with cheaper finance locked in look to secure homes as mortgage rates for new business spike higher but there are wide regional variations in underlying market conditions.

In the last two weeks, there have been some early signs of a decline in demand, dropping below 2019 levels, which is likely to increase over the summer.

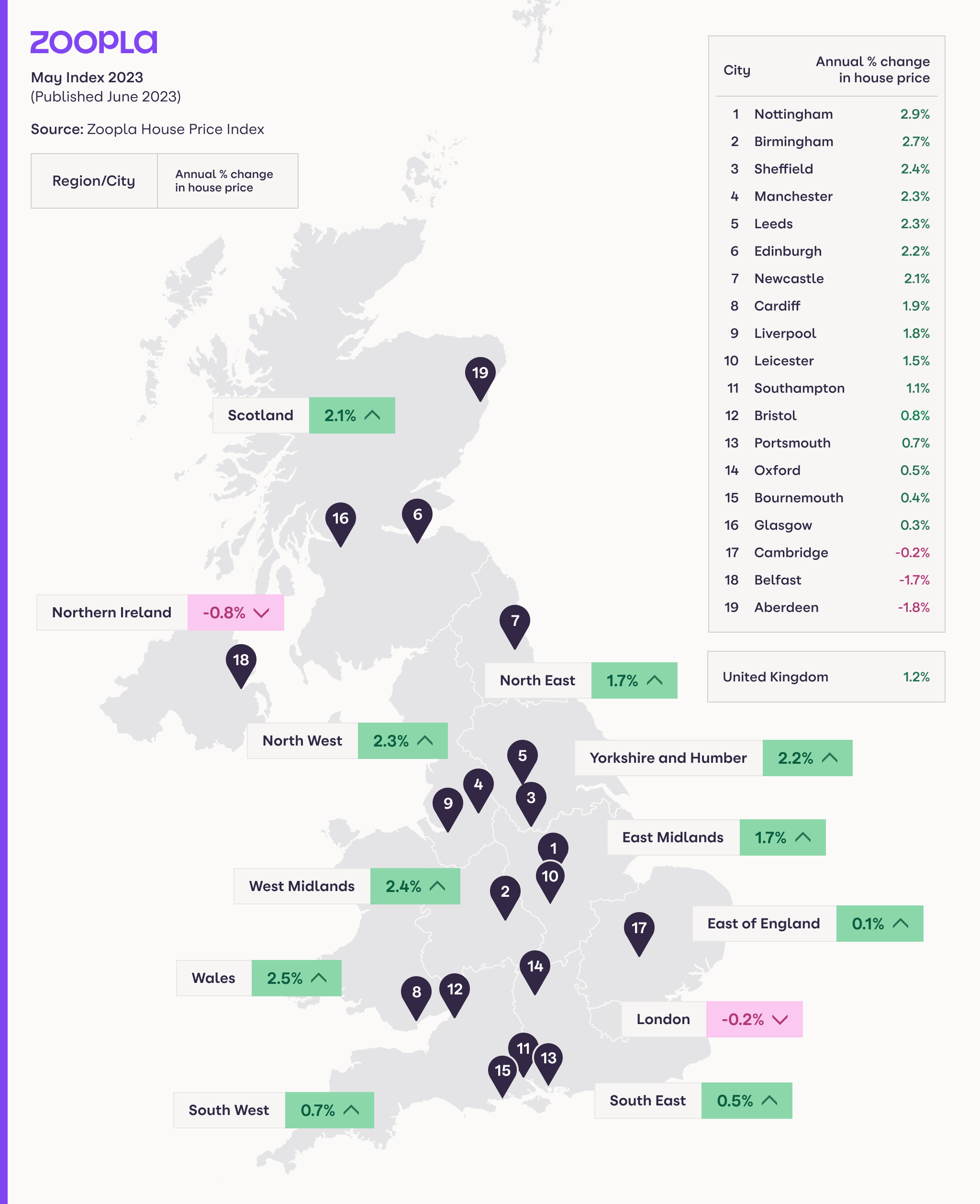

While quarterly price falls have slowed, the annual rate of UK price growth continues to slow rapidly and now stands at +1.2%. On a regional basis, house price growth ranges from +2.5% in Wales to -0.8% in Northern Ireland. Average prices in London are -0.2% lower while all other areas are registering very low positive price growth.

The momentum in sales over H1 is not going to be maintained into H2. Higher mortgage rates will hit buying power and squeeze more buyers out of the market bringing a return to small quarterly price declines in H2. UK house prices remain on track to fall by up to 5% over 2023.

Our data shows 14% fewer buyers in the market over the last 4 weeks than the average over the last 5 years. However, those that remain appear committed to moving home. This is evidenced by sales agreed running 8% above average, although with wide regional variations in the underlying supply/demand balance.

The number of new sales being agreed continues to run above the national average in Scotland, the North East, where housing is more affordable, and in London where price rises have under-performed.

Sales volumes remain at or below average in most English regions where house prices registered some of the greatest gains over the pandemic years. This has made homes less affordable, exposing sales volumes to the impact of higher mortgage rates on buying power.

Our localised house price indices show a clear link between price growth and the level of actual house prices. It’s markets with average prices over £350,00 where further price falls are most likely. The East of England, South-West, East Midlands and South-East are areas where it appears house prices will need to adjust the most.

Today’s buyers are driving a harder bargain on agreed pricing. Sellers are having to accept lower offers that, on average, are 3.8% below the original asking price, according to our data business Hometrack.

We have also seen a jump in the proportion of sellers accepting bigger discounts on asking prices recently. More than two-fifths of sellers (42%) are having to accept offers that are more than 5% below the asking price – the highest level since 2018 when annual UK house price growth was just 1%.

Over 1 in 6 sellers are accepting discounts greater than 10% below the asking price, a level that remains more stable.

Looking ahead, mortgage rates look set to remain above 5% over the coming months, delivering a further hit to the buying power of mortgage-reliant movers who account for 7 in 10 purchases. If money market expectations change then mortgage rates could start falling.

We have updated our analysis on the extent to which higher mortgage rates reduce household buying power for an average purchaser with a 75% loan-to-value mortgage.

Mortgage rates moving from 4% to 5% drive an 11% reduction in buying power. The gap rises to 20% if mortgage rates move from 4% to 6%. This will not feed directly into house prices. The hit to buying power from borrowing costs rising from 2% to 4% has slowed the rate of price growth rather than driving sizeable year-on-year price falls.

Lower sales volumes have also masked the impact to some degree. Buyers can offset reduced buying power by either 1) injecting more equity into purchases and/or 2) taking longer mortgage terms. However, these aren’t options for everyone. The longer rates stay above 5%, the greater the impact on the number of buyers in the market which impacts sales volumes and price inflation.

Aside from weaker economic growth, the main downside risk to house prices is a surge in the supply of homes for sale. There are some signs that supply is starting to grow at an above-average rate with 18% more homes listed for sale in the last 4 weeks than the 5-year average.

The number of homes for sale is back to pre-pandemic levels. Further expansion in homes for sale, either voluntarily, or partially forced through changing circumstances would boost supply. This would increase choice and create further room for negotiation on price.

Bank of England data shows mortgage arrears rates have increased off a low base in Q1 2023. Anecdotal evidence from industry insiders suggests that most borrowers are paying the extra monthly mortgage costs at refinancing rather than extending mortgage terms. 15% of mortgagees will refinance this year. These extra measures to boost forbearance for mortgagees will limit forced sales in the near term.

The desire to move home continues to be driven by a range of demographic and lifestyle factors. It’s certainly not all about aspiration for a bigger or better property. We believe that rising living and housing costs will continue to keep owners reviewing their housing needs with moving the best option for some out of choice or necessity. Whatever the motivations, the key message for anyone serious about moving in 2023 is the need to be realistic on price, seeking the views and expertise of local agents as they plan their move.

The resilience of the housing market and homebuyers is set to be tested once again as mortgage rates increase over 5%. Firmer pricing this spring shows 4-5% mortgage rates are manageable, but the longer rates stay over 5%, and closer to 6%, the increased hit to buying power will result in lower prices and sales volumes.

The transition to higher borrowing costs will take time to feed through. Lower sales, on track to be 20% down on last year, has been the main initial impact.

There is a large equity buffer to absorb house price falls making the risk of negative equity much smaller than in previous downturns. The bigger challenge for housing activity is the affordability of monthly payments for buyers, and those remortgaging, set against the wider increase in other costs of living.

Household budgets are being squeezed and we look set for a prolonged period of low nominal house price growth which will result in a steady re alignment of house prices and household incomes over the next 3-5 years.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

Market activity improves across all key measures led by sales, which are 9% higher than a year ago.

Our Rental Market Report for March 2024 looks at the latest trends in rental pricing, supply and demand.

The positive momentum in the housing market continues with buyers and sellers attracted by lower mortgage rates and sales agreed up 15% YoY.